The eCommerce industry naturally accommodates to disruptive technology, but TEMU presents an existential threat to the current generation of online retailers.

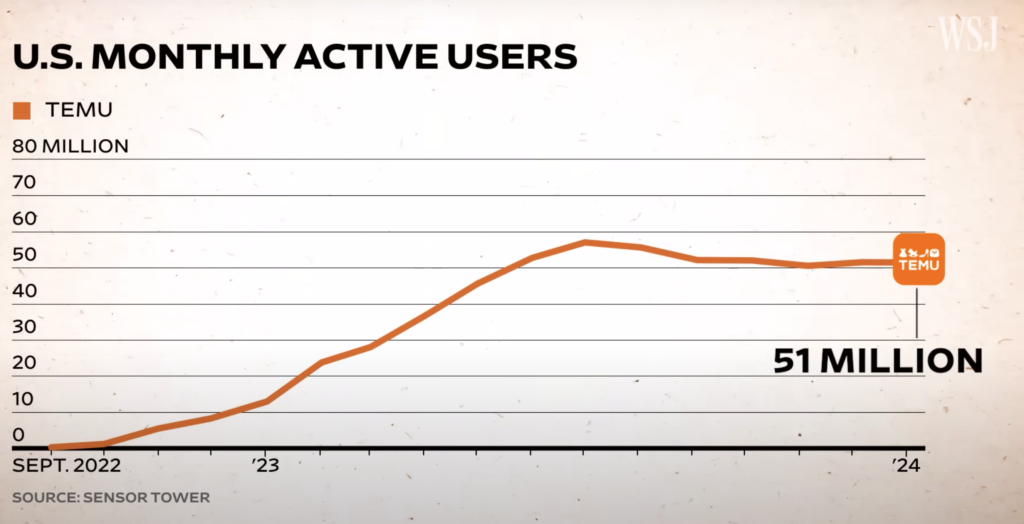

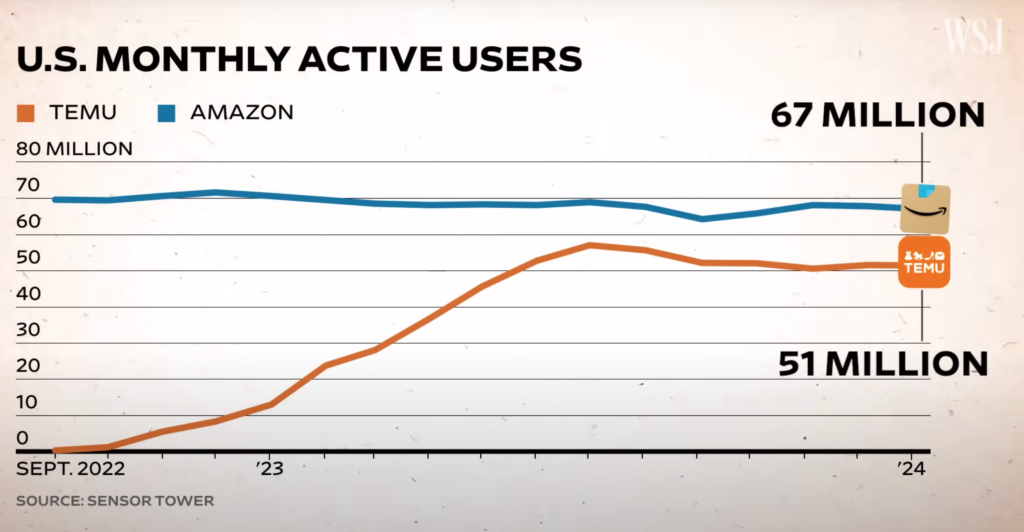

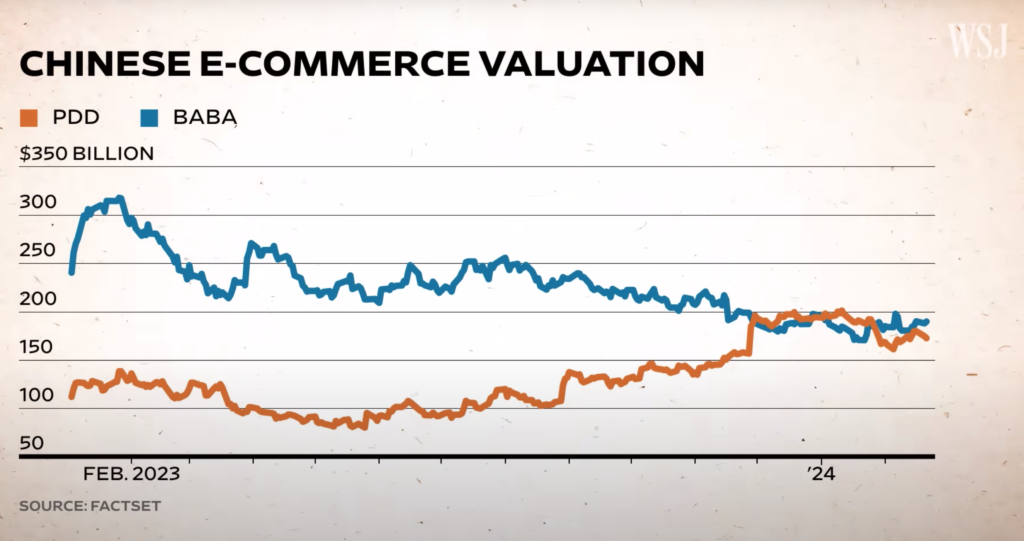

Welcome to the age of instant gratification—except, apparently, when it comes to online shopping. Contrary to the stupefyingly efficient delivery standards established by Amazon, it appears slow and steady (and significantly cheaper) is winning the eCommerce industry race. TEMU, the addictively intriguing online retail titan from the Chinese behemoth Pinduoduo Inc has successfully captivated the hearts, minds, and dwindling savings of millennials and Gen Z shoppers across the United States. TEMU has defied American e-commerce retailer trends in almost every capacity and has emerged as a burgeoning existential threat to Amazon and other online US retail giants like Walmart and Target. But why, and how has it happened so swiftly?

The Rise of TEMU: A Lesson in Patience and Prices

Amazon Prime has spoiled us with same-day deliveries, unparalleled inventory of products, and meticulously engineered UX which makes ordering seamless. And then there’s TEMU, which is shockingly enough, asking shoppers to wait—sometimes weeks—for their melange of ultra discounted popular commodities. That is a stark contrast to the paradigm of millenial and Gen Z expectations, which is nothing short of “I want it fast, cheap, and good.” So, what makes TEMU so attractive that young Americans are willing to overlook the mail order catalog era shipping timeline? The answer is as simple as it is compelling: price.

TEMU, part of Pinduoduo Inc., a devastatingly profitable mainstay of Chinese e-commerce, offers products at prices that frequently undercut even the most aggressive Amazon retailers. We’re talking about deals that make Black Friday look like a luxury shopping spree with a bag of cash you found on the side of the road. For millennials burdened with student loans, nominal salaries, and soaring cost of living – not to mention Gen Zers making their adult hood debut in a tumultuous economic landscape – the savings afforded by TEMU are not just attractive; they’re essential.

TEMU – A Wallet-Friendly Wonderland

While seemingly impossible low prices are undoubtedly attractive to audiences of all demographics; it’s the sheer range of products that sets TEMU apart from other amalgamated ecommerce retailer networks. From goth skirts that would make Wednesday Addams jealous to off-brand electronics that promise not to explode—everything is a click and a half-month wait away. This affordability comes from direct connections with manufacturers and a supply chain that cuts out more middlemen than a mob boss trimming “family fat”.

The financial contrast with Amazon is stark. Amazon, with its Prime subscriptions, user-friendly interface, and lightning-fast delivery, appeals to our impatience, but at the expense of premium membership. In contrast, TEMU’s model is like a treasure hunt in a digital bazaar without the shipping speed. But when your shopping cart totals half of what it would on Amazon, waiting doesn’t seem too tedious.

The Existential Threat to US Retailers

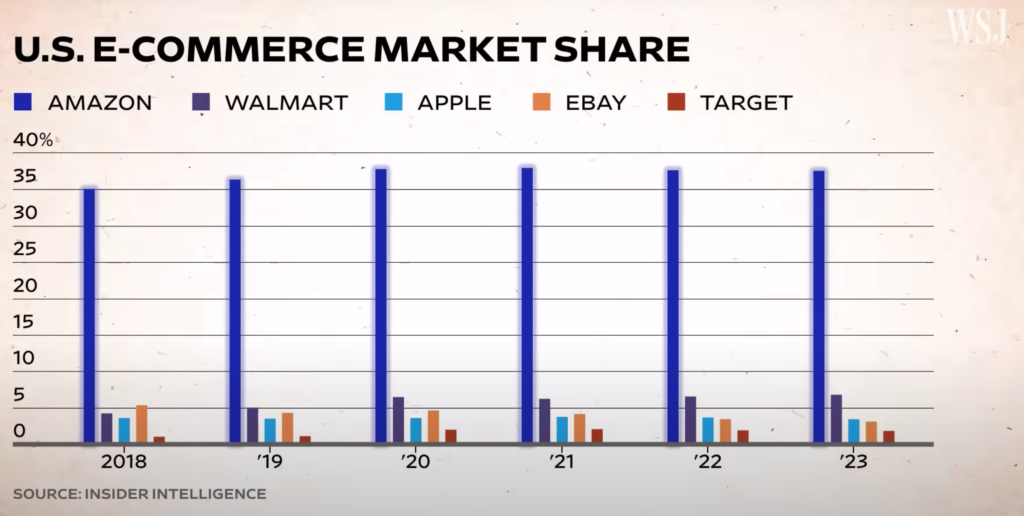

Referring to TEMU an existential threat might sound like hyperbole, but it’s not far off the mark. US e-commerce has been dominated by a few heavy hitters who thought their industry leadership was locked down with fast, reliable, and trackable shipping as their principal value proposition. But TEMU disrupts the entirety of that inherent benefit, with a simple proposition: “Wait longer, pay less.” Surprisingly, an inordinate volume lof shoppers are apt to oblige that opportunity.

This fundamental disruption poses a significant challenge to US retailers, who now have to pivot legacy supply line and pricing strategies to remain relevant (and in business, for that matter). The allure of rapid delivery is losing its sheen against dramatically lower prices. The economics are simple: when a consumer can buy three pairs of pants for the price of one, even a two-week wait can be palatable. This model not only captures a significant market share but forces competitors to slash prices, potentially eroding their profit margins.

Why TEMU’s Slow Boat is Winning Hearts

The attractiveness of TEMU extends beyond just price, particularly to two generations of online shoppers who are inherently aligned with interactive purchasing experiences. TEMU offers nothing short of an adventurous shopping experience, more like navigating an open market in a foreign country. The product descriptions alone provide a mix of unintentional comedy and puzzling poetry that can sometimes lead to purchases just to see if the product is as bizarre as its description promises.

Moreover, TEMU’s marketplace model taps into the joy of discovery in a way that Amazon’s sometimes sterile listings do not. For a generation raised on digital interfaces and interactive content, TEMU’s platform offers a “gamified” shopping experience with addictive undertones. You’re not just buying a yoga mat; you’re on a quest through the digital aisles of global commerce.

The Path Forward: TEMU’s Potential for Growth

Despite economic headwinds, TEMU is poised for explosive growth in the US. Its business model, which capitalizes on direct-from-factory deals, positions it uniquely to offer recession-battered consumers products at prices that traditional retailers find hard (if not impossible) to match. As inflation concerns prompt more consumers to tighten their discretionary purchases, the appeal of TEMU’s unrivaled low-cost options will absolutely increase.

As TEMU continues to scale and potentially streamline its logistics, even moderately improved shipping times could significantly enhance its market position. Even small reductions in wait times could make TEMU an even more formidable competitor in the e-commerce industry, and very likely, a considerable alternative to Amazon.

What comes next in a market that could be dominated by TEMU?

Should traditional retailers be worried? Absolutely. TEMU isn’t just changing the eCommerce industry in the context of pricing for popular products; it’s redefining consumer expectations around cost and delivery times. TEMU is effectively a wake-up call that a generation of eCommerce entrepreneurs didn’t anticipate. It’s a pervasive reminder that in the digital age, adaptation isn’t just an option; it’s a survival strategy.

Millennials and Gen Z might be the pioneers of the TEMU shopping revolution, but the ripples are likely to affect how all demographics shop online. This could be bigger than Ebay in the early 2000’s, more ubiquitous than Amazon is today, and potentially more prolific than Pizza delivery.